Ethereum Price Prediction: Consolidation Phase Precedes Potential Rally to $8,500

#ETH

- Technical Consolidation: ETH trades below its 20-day MA but maintains bullish MACD momentum, with Bollinger Bands suggesting $4,080 as critical support

- Institutional Accumulation: Record-low exchange balances and negative exchange flows indicate strong institutional buying despite short-term price weakness

- Scaling Progress: Vitalik Buterin's positive comments on Ethereum's scaling roadmap provide fundamental support for long-term price appreciation targets reaching $7,500-$8,500

ETH Price Prediction

Technical Analysis: ETH Shows Mixed Signals Near Key Support

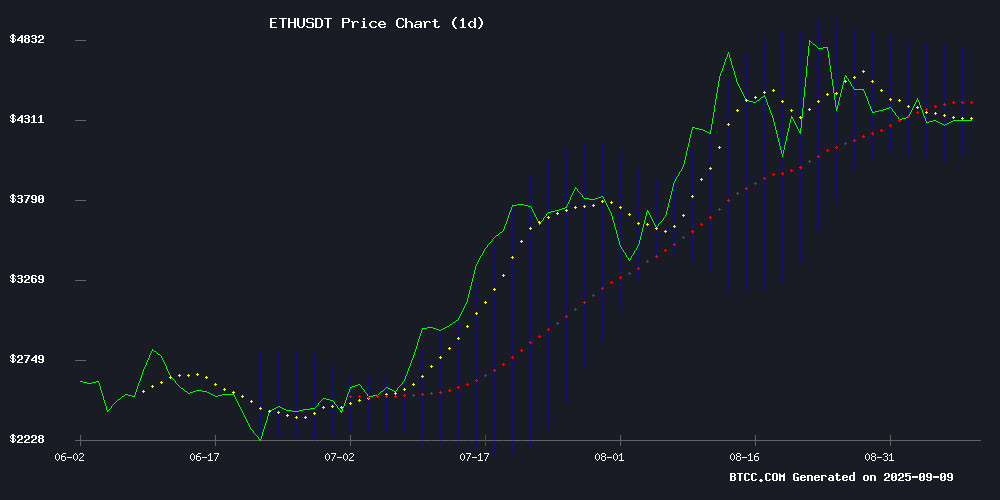

ETH is currently trading at $4,355.69, below its 20-day moving average of $4,433.71, indicating potential short-term weakness. The MACD reading of 165.70 versus a signal line of 65.16 shows bullish momentum remains intact despite recent price consolidation. Bollinger Bands position the current price NEAR the middle band, with support at $4,081.85 and resistance at $4,785.57.

According to BTCC financial analyst Emma, "ETH's position relative to its moving average and Bollinger Bands suggests we're at a critical juncture. Holding above $4,080 could pave the way for a retest of the $4,800 level."

Market Sentiment: Institutional Accumulation Offsets Short-Term Concerns

News FLOW presents a contrasting picture for Ethereum. Positive developments include record-low exchange balances signaling institutional accumulation, Vitalik Buterin's positive comments on scaling progress, and analysts targeting $7,500-$8,500 price levels. However, warnings about weakening momentum and whale activity shifting to alternative projects temper immediate optimism.

BTCC financial analyst Emma notes, "The fundamental narrative remains strong with institutional inflows and technical scaling progress, but technical indicators suggest we may see further consolidation before the next major upward move. The negative exchange balance is particularly bullish for medium-term prospects."

Factors Influencing ETH's Price

Ethereum Recovery Eyes $4,811 Pivot Before $8,500 Target

Ethereum's steady momentum continues to captivate institutional and retail investors alike. The token's unique blockchain infrastructure and yield-generating potential have positioned it as a market leader, with growing demand driving price speculation toward the $8,000 threshold.

Stablecoin deployment on Ethereum's network has surged to a record $165 billion, underscoring its institutional adoption. Analysts highlight the chain's robust ecosystem as a key factor in accommodating regulatory shifts in the stablecoin sector, fueling bullish sentiment.

Vitalik Buterin Commends Lean Ethereum Team's Progress on Scaling Roadmap

Ethereum co-founder Vitalik Buterin praised the Lean ethereum team for their significant advancements in 2025, emphasizing their role in ensuring the blockchain's long-term scalability, decentralization, and resilience. The team's work on LeanVM, a minimal zero-knowledge virtual machine (zkVM), aims to optimize Ethereum's computational efficiency while maintaining compatibility with mainnet operations.

Buterin noted that the Lean roadmap is strategically timed to align with the completion of short-term scaling milestones. "The point is that the Lean roadmap lags behind the short-term scaling milestones so that ideally the former is ready to go exactly once the latter is all on mainnet," he stated. This phased approach ensures seamless integration of upgrades without disrupting network stability.

LeanVM, a stripped-down version of Ethereum's computing engine, is designed to enhance recursion-friendly ZK-proof capabilities. Developers are intentionally sequencing these improvements to coincide with the maturation of immediate scaling solutions, creating a cohesive transition toward a more efficient Ethereum ecosystem.

Ethereum Price Warning – Bulls Losing Grip as Downside Risks Build

Ethereum's recovery attempt above $4,450 has faltered, with the cryptocurrency now facing increased downside pressure. The failure to sustain momentum leaves ETH vulnerable to a potential drop below $4,220, as bears maintain control of the market.

Technical indicators paint a concerning picture. A descending channel formation with resistance at $4,310 suggests continued bearish dominance. The 100-hour moving average currently acts as an overhead cap, while the 50% Fibonacci retracement level NEAR $4,360 presents another critical barrier for any bullish reversal.

Market participants are closely watching the $4,350 level as a potential pivot point. A decisive close above this threshold could signal renewed buying interest, though current conditions favor continued consolidation or further downside.

Ethereum Price Consolidates Amid Weakening Momentum

Ethereum's price action has stalled near $4,300 after weeks of volatility, failing to sustain upward momentum despite reclaiming the $4,000 level earlier this summer. The asset now faces a critical test between technical support and resistance levels.

Short-term moving averages paint a concerning picture, with ETH trapped between the 26-day EMA at $4,144 and the 50-day EMA. This compression typically precedes a breakout, but current market conditions favor bears rather than bulls. Trading volumes have declined steadily since mid-August, reflecting waning conviction from both buyers and sellers.

The Relative Strength Index at 52 signals neutral momentum—neither oversold nor overbought. Without a surge in demand, Ethereum appears vulnerable to further downside. A breakdown could test the 100-day EMA near $3,607, last respected during July's rally. More severe selling pressure might push prices toward the 200-day EMA around $3,190.

Market participants now watch the $4,144–$3,607 range as a bellwether for ETH's next major move. The cryptocurrency's weakest performance since crossing $4,000 leaves traders questioning whether consolidation will yield to renewed strength or deeper correction.

Kinto's K Token Collapses Amid Project Shutdown

Kinto's K token suffered an 85% crash within 24 hours after the DeFi project announced its shutdown. The team cited insurmountable challenges following a July exploit that drained 577 ETH, forcing debt restructuring efforts that ultimately failed.

Users can withdraw assets until September 30, with Phoenix lenders recovering 76% of principal. A $130,000 goodwill fund will compensate Morpho exploit victims up to $1,100 each. "The CPIMP incident was a black swan," conceded founder Ramon Recuero, while emphasizing Core infrastructure remained unhacked.

Ethereum Whale Moves $254 Million After Six Years of Inactivity

Ethereum's price hovered near $4,303 as a dormant whale transferred 58,938 ETH, worth $254 million, after six years of inactivity. A portion of this transfer—21,178 ETH valued at $91.54 million—was sent to Bitfinex, signaling potential selling intent.

The market remains rangebound, with ETH struggling to reclaim $4,500 after peaking at $4,800. Exchange outflows and dormant circulation metrics paint a mixed picture: while whale activity suggests profit-taking, broader capitulation appears absent. Santiment data reveals declines in dormant circulation among long-term holders, indicating selective exits rather than mass sell-offs.

Momentum indicators remain neutral as Ethereum consolidates between $4,200 and $4,600. The lack of sustained upward movement raises questions about whether buyers can regain control in the near term.

Ethereum Faces 2.5% Decline as Whales Pivot to Nexchain Presale

Ethereum's price dipped 2.5% in the past 24 hours, testing key technical levels while maintaining its broader bullish structure. Short-term traders eye the $4,127-$4,356 range, with a breakout above $4,356 potentially fueling a rally toward $5,000. Conversely, losing the 50-day SMA at $3,800 could trigger a deeper correction.

Whale activity shows a notable shift toward emerging presale projects like Nexchain, signaling evolving capital allocation strategies for 2025. The 200-day SMA at $2,728 remains Ethereum's critical long-term support, preserving its macro uptrend despite near-term volatility.

Ethereum Price Forecast: Institutional Inflows Fuel $7,500 ETH Target

Ethereum's march toward $7,500 is gaining credibility as institutional capital floods into the ecosystem. Standard Chartered revised its year-end price target upward by 87% to $7,500, citing accelerating corporate treasury adoption and ETF inflows that have absorbed 5% of circulating supply since June.

The bank identifies a self-reinforcing cycle developing: nearly $8 billion worth of ETH was removed from markets in August alone, while Q2 2025 saw Ethereum ETFs overtake Bitcoin products with $4 billion in net inflows. This accumulation trend is mirrored by bullish projections from Wallet Investor and InvestingHaven, both aligning around the $7,000-$7,500 range.

On-chain metrics reveal deepening institutional commitment, with staking activity and treasury purchases creating structural supply constraints. The growing consensus suggests Ethereum is transitioning from speculative asset to institutional-grade holding, with traditional finance now driving price discovery.

Ethereum Exchange Balance Turns Negative For The First Time – A Bullish Signal

Ethereum has reached a historic milestone as its exchange balance turns negative for the first time, signaling a potential bullish shift in market dynamics. More ETH is being withdrawn from exchanges than deposited, reducing liquid supply and indicating stronger investor confidence.

Crypto analyst Cas Abbe highlights this development as a key indicator of reduced selling pressure. Exchange balances have long served as a barometer for investor behavior—rising balances suggest impending sell-offs, while declining balances point to long-term holding strategies.

The accelerated withdrawal of billions in ETH from centralized platforms coincides with Ethereum's push toward $5,500. This structural supply contraction creates fundamental support for price appreciation.

SharpLink Explores Ethereum Staking on Linea Network to Diversify Treasury Strategy

SharpLink Gaming, a major holder of Ethereum treasury assets, is considering staking part of its $3.6 billion ETH holdings on the Linea layer-2 network. The MOVE aims to diversify the company's yield strategy while supporting Ethereum's scaling solutions ahead of Linea's mainnet launch on September 10.

By joining the Linea Consortium, SharpLink positions itself as a key governance participant with access to 75% of LINEA token distribution. The firm emphasizes compliance with Nasdaq regulations, noting its existing authorization for Ethereum purchases without additional shareholder approvals.

Ethereum Outflows Signal Institutional Accumulation as Exchange Balances Hit Record Lows

Ethereum's exchange dynamics reveal a striking shift in market behavior. The network's exchange 'flux' metric—tracking cumulative net flows—has turned negative for the first time in history. This inversion signals more aggressive buying than selling, with institutional players leading the charge.

Yunfeng Financial Group, backed by Jack Ma, recently allocated $44 million to ETH reserves. BitMine Immersion Technologies amplified its position to 1.86 million ETH, now controlling 1.5% of the total supply. Meanwhile, three ICO-era whales opted to stake $645 million worth of ETH rather than liquidate, underscoring Ethereum's evolution into a yield-bearing asset.

CryptoQuant data confirms the trend: ETH balances on exchanges have plunged to unprecedented lows. The migration of assets from trading platforms to long-term staking addresses suggests a structural change in holder psychology—from speculative trading to strategic accumulation.

Is ETH a good investment?

Based on current technical and fundamental analysis, ETH presents a compelling investment opportunity with measured risk. The cryptocurrency is currently in a consolidation phase trading at $4,355.69, which is 1.8% below its 20-day moving average. Several factors support a bullish medium-term outlook:

| Indicator | Current Value | Implication |

|---|---|---|

| Price | $4,355.69 | Below MA, consolidation phase |

| MACD | 165.70 (Bullish) | Positive momentum maintained |

| Bollinger Support | $4,081.85 | Key downside protection level |

| Exchange Balances | Negative (First Time) | Strong institutional accumulation |

BTCC financial analyst Emma suggests: "While short-term volatility may persist, the combination of technical support levels, positive MACD momentum, and fundamental factors like institutional accumulation and scaling progress creates a favorable risk-reward ratio for medium to long-term investors. The $4,080 support level appears crucial for maintaining bullish structure."